NEWS

Industry News

Notice Regarding Structural Reorganization of NSK Group Companies by Company Split and Absorption-type Merger

Time:28 Apr,2016

Tokyo, Japan, April 26, 2016 - NSK Ltd. (hereinafter, “NSK”; Headquarters: Tokyo, Japan; President and CEO: Toshihiro Uchiyama) hereby announces that it has resolved today to conduct structural reorganization of NSK Group companies (hereinafter, the “Reorganization”). Details are provided below; however, as the Reorganization falls under a summary and short form reorganization, the particulars and content for disclosure have been partially abridged.

1. Purpose of the Reorganization

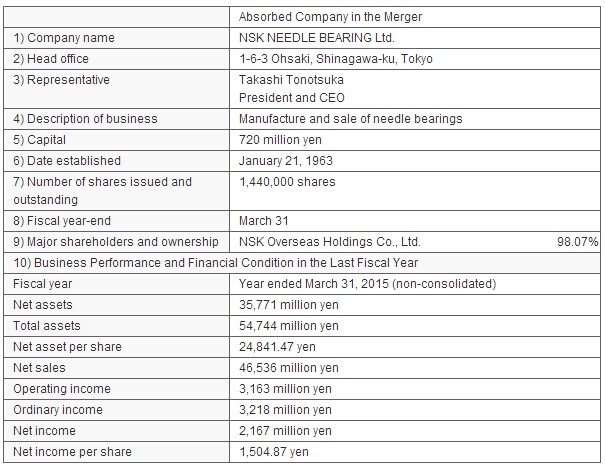

NSK NEEDLE BEARRING Ltd. (hereinafter, “NNBH”), a subsidiary of NSK, and its group companies mainly manufacture needle bearings at its plants located in Japan, Europe, and Asia, for use in automotive transmissions and other applications. The automotive market is currently experiencing significant changes with increasing efficiency and diversification of automatic transmission technology and expansion into newly emerging markets. Against this background, NSK will merge NNBH by absorption with the aim of deploying growth strategies and improving the efficiency of its corporate structure.

2. Summary of the Reorganization

NSK will succeed to NNBH shares owned by NSK Overseas Holdings Co., Ltd. (hereinafter, “NOH”), a wholly owned subsidiary of NSK, through a company split (hereinafter, the “Company Split"), and conduct an absorption-type merger in which NSK will serve as a surviving company and NNBH will serve as an absorbed company (hereinafter, the “Merger").

3. Overview of the Company Split

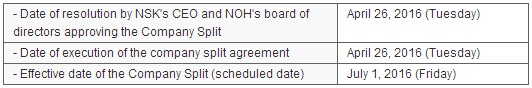

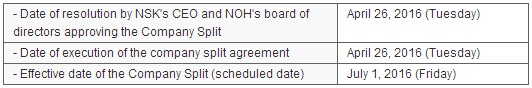

(1) Schedule

Note: As the Company Split falls under (i) a summary company split defined under Article 796, Item 2 of the Companies Act of Japan as to NSK and (ii) a short-form company split under Article 784, Item 1, of the said act as to NOH, NSK and NOH will not hold their respective general meetings of shareholders for obtaining approval for the company split agreement.

(2) Method of the Company Split

The Company Split will be implemented by way of an absorption-type company split, in which NOH will serve as a splitting company and NSK will serve as a successor company.

(3) Share Allotment under the Company Split

Since NOH is a wholly owned subsidiary of NSK, NSK will not allot its shares to NOH.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Splitting Company under the Company Split

Not applicable.

(5) Change in Capital Stock

The Company Split will cause no change in NSK's capital stock.

(6) Rights and Obligations to be Succeeded to by the Successor Company (NSK)

NSK will succeed to NNBH shares owned by NOH.

(7) Outlook for Performance of Obligations

NSK is not expected to encounter any difficulty in carrying out its due obligations which NSK shall perform after the effective date of the Company Split.

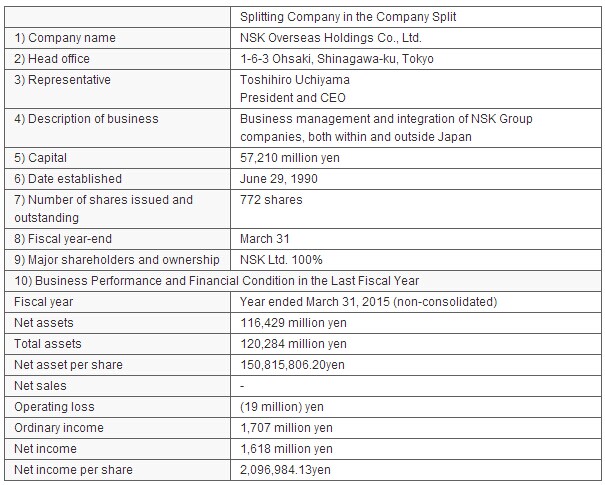

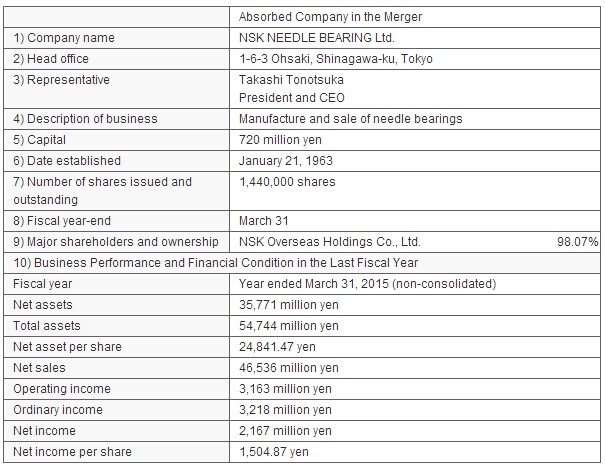

(8) Overview of the Parties Concerned

See item 6 below.

4. Overview of the Merger

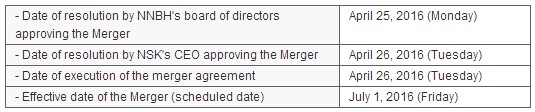

(1) Schedule

Note: As the Company Split falls under (i) a summary company split defined under Article 796, Item 2 of the Companies Act of Japan as to NSK and (ii) a short-form company split under Article 784, Item 1, of the said act as to NOH, NSK and NOH will not hold their respective general meetings of shareholders for obtaining approval for the company split agreement.

(2) Method of the Company Split

The Company Split will be implemented by way of an absorption-type company split, in which NOH will serve as a splitting company and NSK will serve as a successor company.

(3) Share Allotment under the Company Split

Since NOH is a wholly owned subsidiary of NSK, NSK will not allot its shares to NOH.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Splitting Company under the Company Split

Not applicable.

(5) Change in Capital Stock

The Company Split will cause no change in NSK's capital stock.

(6) Rights and Obligations to be Succeeded to by the Successor Company (NSK)

NSK will succeed to NNBH shares owned by NOH.

(7) Outlook for Performance of Obligations

NSK is not expected to encounter any difficulty in carrying out its due obligations which NSK shall perform after the effective date of the Company Split.

(8) Overview of the Parties Concerned

See item 6 below.

4. Overview of the Merger

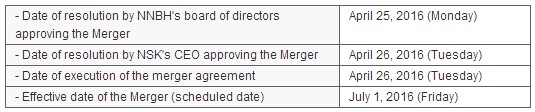

(1) Schedule

Note: As the Merger falls under (i) a summary merger defined under Article 796, Item 2 of the Companies Act of Japan as to NSK, and (ii) a short-form merger defined under Article 784, Item 1, of the said act as to NNBH, NSK and NNBH will not hold their respective general meetings of shareholders for obtaining approval for the merger agreement.

(2) Method of the Merger

The Merger will be implemented by way of an absorption-type merger, in which NSK will serve as a surviving company and NNBH will serve as an absorbed company.

(3) Share Allotment under the Merger

Note: As the Merger falls under (i) a summary merger defined under Article 796, Item 2 of the Companies Act of Japan as to NSK, and (ii) a short-form merger defined under Article 784, Item 1, of the said act as to NNBH, NSK and NNBH will not hold their respective general meetings of shareholders for obtaining approval for the merger agreement.

(2) Method of the Merger

The Merger will be implemented by way of an absorption-type merger, in which NSK will serve as a surviving company and NNBH will serve as an absorbed company.

(3) Share Allotment under the Merger

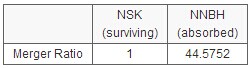

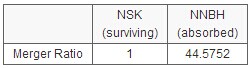

*1 Share Exchange Ratio

NSK will allot 44.5752 shares of common stock per one share of common stock of NNBH. However, there will be no allotment regarding the 1,412,170 shares of common stock of NNBH to be owned by NSK.

*2 Share Allotment under the Merger

NSK will allocate 1,240,527 shares (planned) in treasury stock for the shares to be delivered upon the Merger and will not issue any new stock.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Absorbed Company

Not applicable.

(5) Overview of the Parties Concerned

See item 6 below.

5. Basis of Calculation for Share Allotment under the Merger

For the sake of objectivity, both NSK and NNBH delegated the calculation of the merger ratio to independent third party organizations, with these calculations used as a reference in reaching an agreement on merger ration between NSK and NNBH after their negotiation. Calculations were based on a market price method (applied to NSK only, as NNBH is unlisted), a comparable peer company method and a discounted cash flow (DCF) analysis method, from which an assessment of company value of NSK and NNBH was made, and a suitable merger ratio was proposed taking into account such overall assessment. There were no predictions of material change in profits or loss in any fiscal year for either company in the financial forecasts used for the purpose of these calculations.

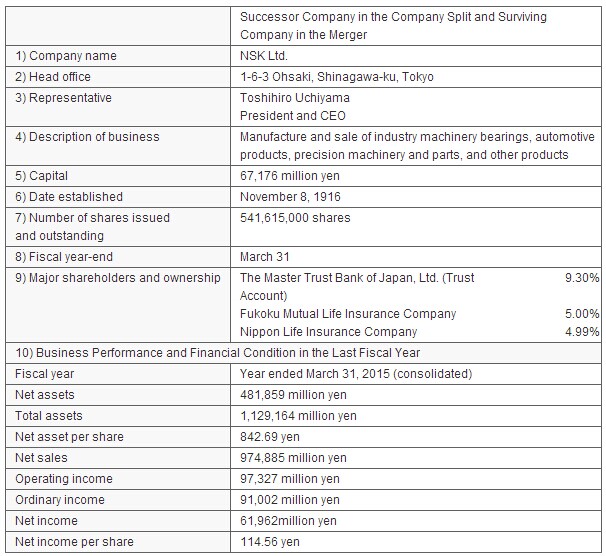

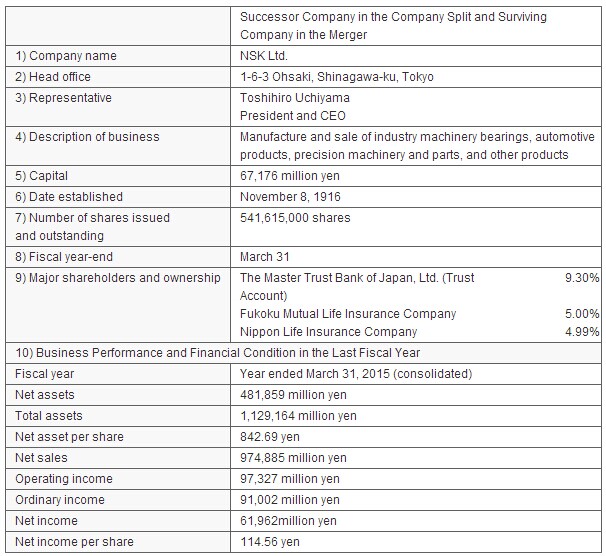

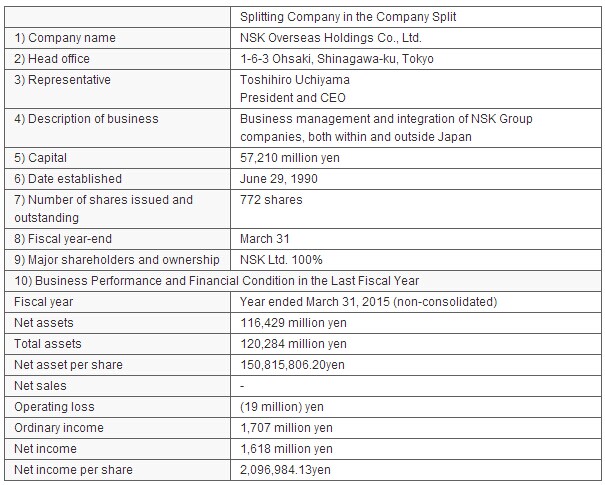

6. Profile of the Parties in the Company Split and the Merger

7. Status Following the Reorganization

There will be no change to NSK's company name, head office location, representative, description of business, capital stock or fiscal year as a result of the Reorganization.

8. Effects on NSK's Business Performance

NSK does not expect any significant effects from the Reorganization on its business performance.

*1 Share Exchange Ratio

NSK will allot 44.5752 shares of common stock per one share of common stock of NNBH. However, there will be no allotment regarding the 1,412,170 shares of common stock of NNBH to be owned by NSK.

*2 Share Allotment under the Merger

NSK will allocate 1,240,527 shares (planned) in treasury stock for the shares to be delivered upon the Merger and will not issue any new stock.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Absorbed Company

Not applicable.

(5) Overview of the Parties Concerned

See item 6 below.

5. Basis of Calculation for Share Allotment under the Merger

For the sake of objectivity, both NSK and NNBH delegated the calculation of the merger ratio to independent third party organizations, with these calculations used as a reference in reaching an agreement on merger ration between NSK and NNBH after their negotiation. Calculations were based on a market price method (applied to NSK only, as NNBH is unlisted), a comparable peer company method and a discounted cash flow (DCF) analysis method, from which an assessment of company value of NSK and NNBH was made, and a suitable merger ratio was proposed taking into account such overall assessment. There were no predictions of material change in profits or loss in any fiscal year for either company in the financial forecasts used for the purpose of these calculations.

6. Profile of the Parties in the Company Split and the Merger

7. Status Following the Reorganization

There will be no change to NSK's company name, head office location, representative, description of business, capital stock or fiscal year as a result of the Reorganization.

8. Effects on NSK's Business Performance

NSK does not expect any significant effects from the Reorganization on its business performance.

Note: As the Company Split falls under (i) a summary company split defined under Article 796, Item 2 of the Companies Act of Japan as to NSK and (ii) a short-form company split under Article 784, Item 1, of the said act as to NOH, NSK and NOH will not hold their respective general meetings of shareholders for obtaining approval for the company split agreement.

(2) Method of the Company Split

The Company Split will be implemented by way of an absorption-type company split, in which NOH will serve as a splitting company and NSK will serve as a successor company.

(3) Share Allotment under the Company Split

Since NOH is a wholly owned subsidiary of NSK, NSK will not allot its shares to NOH.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Splitting Company under the Company Split

Not applicable.

(5) Change in Capital Stock

The Company Split will cause no change in NSK's capital stock.

(6) Rights and Obligations to be Succeeded to by the Successor Company (NSK)

NSK will succeed to NNBH shares owned by NOH.

(7) Outlook for Performance of Obligations

NSK is not expected to encounter any difficulty in carrying out its due obligations which NSK shall perform after the effective date of the Company Split.

(8) Overview of the Parties Concerned

See item 6 below.

4. Overview of the Merger

(1) Schedule

Note: As the Company Split falls under (i) a summary company split defined under Article 796, Item 2 of the Companies Act of Japan as to NSK and (ii) a short-form company split under Article 784, Item 1, of the said act as to NOH, NSK and NOH will not hold their respective general meetings of shareholders for obtaining approval for the company split agreement.

(2) Method of the Company Split

The Company Split will be implemented by way of an absorption-type company split, in which NOH will serve as a splitting company and NSK will serve as a successor company.

(3) Share Allotment under the Company Split

Since NOH is a wholly owned subsidiary of NSK, NSK will not allot its shares to NOH.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Splitting Company under the Company Split

Not applicable.

(5) Change in Capital Stock

The Company Split will cause no change in NSK's capital stock.

(6) Rights and Obligations to be Succeeded to by the Successor Company (NSK)

NSK will succeed to NNBH shares owned by NOH.

(7) Outlook for Performance of Obligations

NSK is not expected to encounter any difficulty in carrying out its due obligations which NSK shall perform after the effective date of the Company Split.

(8) Overview of the Parties Concerned

See item 6 below.

4. Overview of the Merger

(1) Schedule

Note: As the Merger falls under (i) a summary merger defined under Article 796, Item 2 of the Companies Act of Japan as to NSK, and (ii) a short-form merger defined under Article 784, Item 1, of the said act as to NNBH, NSK and NNBH will not hold their respective general meetings of shareholders for obtaining approval for the merger agreement.

(2) Method of the Merger

The Merger will be implemented by way of an absorption-type merger, in which NSK will serve as a surviving company and NNBH will serve as an absorbed company.

(3) Share Allotment under the Merger

Note: As the Merger falls under (i) a summary merger defined under Article 796, Item 2 of the Companies Act of Japan as to NSK, and (ii) a short-form merger defined under Article 784, Item 1, of the said act as to NNBH, NSK and NNBH will not hold their respective general meetings of shareholders for obtaining approval for the merger agreement.

(2) Method of the Merger

The Merger will be implemented by way of an absorption-type merger, in which NSK will serve as a surviving company and NNBH will serve as an absorbed company.

(3) Share Allotment under the Merger

*1 Share Exchange Ratio

NSK will allot 44.5752 shares of common stock per one share of common stock of NNBH. However, there will be no allotment regarding the 1,412,170 shares of common stock of NNBH to be owned by NSK.

*2 Share Allotment under the Merger

NSK will allocate 1,240,527 shares (planned) in treasury stock for the shares to be delivered upon the Merger and will not issue any new stock.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Absorbed Company

Not applicable.

(5) Overview of the Parties Concerned

See item 6 below.

5. Basis of Calculation for Share Allotment under the Merger

For the sake of objectivity, both NSK and NNBH delegated the calculation of the merger ratio to independent third party organizations, with these calculations used as a reference in reaching an agreement on merger ration between NSK and NNBH after their negotiation. Calculations were based on a market price method (applied to NSK only, as NNBH is unlisted), a comparable peer company method and a discounted cash flow (DCF) analysis method, from which an assessment of company value of NSK and NNBH was made, and a suitable merger ratio was proposed taking into account such overall assessment. There were no predictions of material change in profits or loss in any fiscal year for either company in the financial forecasts used for the purpose of these calculations.

6. Profile of the Parties in the Company Split and the Merger

7. Status Following the Reorganization

There will be no change to NSK's company name, head office location, representative, description of business, capital stock or fiscal year as a result of the Reorganization.

8. Effects on NSK's Business Performance

NSK does not expect any significant effects from the Reorganization on its business performance.

*1 Share Exchange Ratio

NSK will allot 44.5752 shares of common stock per one share of common stock of NNBH. However, there will be no allotment regarding the 1,412,170 shares of common stock of NNBH to be owned by NSK.

*2 Share Allotment under the Merger

NSK will allocate 1,240,527 shares (planned) in treasury stock for the shares to be delivered upon the Merger and will not issue any new stock.

(4) Handling of Share Option and Corporate Bonds with Share Option of the Absorbed Company

Not applicable.

(5) Overview of the Parties Concerned

See item 6 below.

5. Basis of Calculation for Share Allotment under the Merger

For the sake of objectivity, both NSK and NNBH delegated the calculation of the merger ratio to independent third party organizations, with these calculations used as a reference in reaching an agreement on merger ration between NSK and NNBH after their negotiation. Calculations were based on a market price method (applied to NSK only, as NNBH is unlisted), a comparable peer company method and a discounted cash flow (DCF) analysis method, from which an assessment of company value of NSK and NNBH was made, and a suitable merger ratio was proposed taking into account such overall assessment. There were no predictions of material change in profits or loss in any fiscal year for either company in the financial forecasts used for the purpose of these calculations.

6. Profile of the Parties in the Company Split and the Merger

7. Status Following the Reorganization

There will be no change to NSK's company name, head office location, representative, description of business, capital stock or fiscal year as a result of the Reorganization.

8. Effects on NSK's Business Performance

NSK does not expect any significant effects from the Reorganization on its business performance.

MANAGER Wang

MANAGER Wang +86-159 6666 2619

+86-159 6666 2619 1-1514,building2,No.15612,century avenue,hightech zone,jinan,shandong,china.

1-1514,building2,No.15612,century avenue,hightech zone,jinan,shandong,china. MANAGER Wang

MANAGER Wang +86-159 6666 2619

+86-159 6666 2619 +86-531-88684258

+86-531-88684258 +86-531-88684258

+86-531-88684258 admin@vgb-bearing.com

admin@vgb-bearing.com 1-1514,building2,No.15612,century avenue

1-1514,building2,No.15612,century avenue